Author :Erin El Issa | Source : Nerdwallet.com

In keeping with NerdWallet’s mission to provide clarity for all of life’s financial decisions, we examined whether consumers are getting the best deals — and, if not, how they could.

Key findings

- 83% of consumers apply for credit cards at the wrong time, forfeiting an average of 15,338 miles or points.

- Consumers miss out on an average of $177 worth of rewards when they apply for travel cards at the wrong time. But waiting for the right time has a cost, too.

- Consumers should apply for a travel card at least five months before they intend to travel to take advantage of the sign-up bonus.

In this report, we’ll look at patterns in limited-time offers and credit card applications; the cost of choosing to wait for an increased sign-up bonus or forgo it for regular rewards; and the ideal time to apply for a credit card based on your travel dates. Sean McQuay, NerdWallet’s resident credit card expert and a former strategy analyst at Visa, shows how consumers can use this information to get the most out of their travel rewards cards.

Bad timing: Consumers are missing out on thousands of rewards points

83% of consumers apply for credit cards at the wrong time, forfeiting an average of 15,338 miles or points.

Credit card issuers put out limited-time offers — temporarily increased sign-up bonuses — on their travel cards, sometimes once or twice per year.

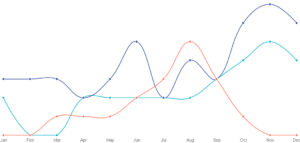

The best and worst times to apply for a travel credit card depend on the type of card.

- General travel cards

- Airline cards

- Hotel cards

Co-branded credit cards carry the name of a specific airline or a hotel chain and are issued by a bank in partnership with that brand. Issuer-branded cards, on the other hand, don’t have partnerships; they carry only the name of the issuer. Our analysis found that applications and limited-time offers were at their highest levels at different times for each type of card.

FULL STORY >>>